How I Cracked Early Retirement by Mastering the Real Cost Game

What if retiring years ahead of schedule isn’t about earning more, but spending smarter? I spent years chasing high returns—until I realized the real game was hidden in plain sight: cost analysis. It wasn’t just about cutting coffee runs. By reverse-engineering my expenses and understanding their long-term weight, I reshaped my entire financial path. This is how I did it—and how you can too. The journey wasn’t fueled by sudden windfalls or risky bets. Instead, it began with a quiet realization: every dollar saved today doesn’t just stay in your pocket—it multiplies into freedom tomorrow. For many women in their 30s to 50s, juggling family, responsibilities, and long-term goals, this kind of control isn’t just empowering—it’s transformative.

The Awakening: Why Early Retirement Started with a Budget

For years, I believed that financial freedom meant earning more. I read books about stock picks, attended webinars on side hustles, and even dabbled in real estate forums. But despite a stable job and decent pay, I never felt ahead. My savings grew slowly, and the dream of stepping back from full-time work felt like a fantasy reserved for the wealthy or the lucky. The turning point came not from a financial advisor or a viral investing trend, but from a simple spreadsheet. One rainy Sunday afternoon, I decided to list every single expense from the past three months. No judgment, no shortcuts—just raw numbers.

What emerged wasn’t shocking, but it was revealing. I wasn’t living extravagantly, yet small, recurring charges—streaming services, monthly subscriptions, recurring delivery fees, and underused memberships—were quietly draining over $300 a month. That’s nearly $4,000 a year vanishing without delivering proportional value. More troubling was housing: my mortgage and property taxes consumed nearly 38% of my take-home pay, far above the recommended 28–30%. Insurance premiums, car payments, and even grocery delivery markups added up in ways I had never fully accounted for. The realization wasn’t that I was spending irresponsibly, but that I was spending unconsciously.

This moment marked a shift—from focusing solely on income to embracing cost awareness as a core financial skill. Budgeting wasn’t about restriction; it was about clarity. It allowed me to see where my money was truly going and identify which expenses were aligned with my long-term goals and which were merely habits. For women managing household finances, this kind of insight is invaluable. It transforms money from a source of stress into a tool for intentionality. Tracking every dollar became the foundation of my retirement strategy, not because it felt dramatic, but because it was sustainable. And sustainability, not sacrifice, is what makes early retirement achievable.

The Hidden Math of Freedom: How Every Dollar Saved Speeds Up Retirement

Financial independence is often portrayed as a distant finish line, reachable only through high salaries or aggressive investing. But the truth is far more empowering: it’s governed by a simple equation. Your retirement number—the amount you need to stop working—is directly tied to your annual expenses. The lower your spending, the less capital you need to accumulate. This means that every dollar you save in monthly expenses reduces the total savings target and shortens your path to retirement. In fact, reducing expenses has the same mathematical impact as increasing income, but without the uncertainty or effort of earning more.

Consider this: if your annual expenses are $60,000, the traditional 4% rule suggests you need $1.5 million saved to retire safely. But if you reduce those expenses to $48,000—a 20% cut—you only need $1.2 million. That’s $300,000 less in savings required. And if you’re saving $15,000 a year, that difference translates to roughly 20 fewer years of saving. Even a modest reduction—say, $500 a month—can accelerate your timeline by five to seven years. This isn’t theoretical; it’s arithmetic. And unlike stock market returns, which fluctuate and can’t be guaranteed, cost control is entirely within your grasp.

What makes this approach especially powerful for women in midlife is its reliability. You don’t need a promotion, a side hustle, or a market boom. You just need awareness and consistency. By focusing on expenses, you shift from depending on external factors to building internal control. This sense of agency is critical, particularly for those who may have taken time off for caregiving or faced income gaps. The math doesn’t penalize you for earning less—it rewards you for spending wisely. Over time, this mindset becomes a compounding force: each saved dollar not only reduces your retirement number but also earns returns in your investment accounts, creating a double benefit. The real game isn’t out-earning your lifestyle; it’s outsmarting it.

Fixed vs. Flexible: Identifying the Costs That Really Matter

Not all expenses are created equal. Some are fixed—like rent or a car loan—while others are flexible, such as dining out or entertainment. The key to accelerating retirement lies in identifying which costs have the highest long-term impact and which can be adjusted with minimal disruption to your quality of life. Fixed expenses, though often seen as unavoidable, are actually the most powerful levers for change. Because they recur month after month, even small reductions create massive savings over time.

Housing is typically the largest fixed cost for most households. For me, it accounted for nearly 40% of my budget. After analyzing my options, I considered relocating to a lower-cost area, refinancing my mortgage at a lower rate, and even exploring downsizing. Each option had trade-offs, but the potential savings were undeniable. A 1% reduction in my mortgage rate saved over $200 a month—more than $2,400 annually. Similarly, switching from a leased car to an owned, fuel-efficient model eliminated a $450 monthly payment and cut insurance and maintenance costs by nearly half. These weren’t drastic lifestyle changes; they were strategic decisions that paid dividends for years.

Insurance is another often-overlooked area. Many people pay for coverage they no longer need or miss out on discounts for bundling policies. A simple review of my auto, home, and health insurance revealed I was overpaying by nearly $1,800 a year. By shopping around and adjusting deductibles, I retained strong protection while lowering premiums. The lesson? Fixed costs aren’t set in stone. They’re negotiable, refinable, and re-evaluable. For women managing family budgets, this kind of proactive review can free up thousands without requiring anyone to give up what they love. It’s not about cutting joy—it’s about cutting waste.

The Lifestyle Audit: What I Kept, What I Cut, and Why

I didn’t adopt a life of austerity. In fact, one of the most important insights from my journey was that financial freedom isn’t about deprivation—it’s about alignment. I wanted to enjoy life now while building security for the future. So instead of slashing every non-essential, I conducted a three-month lifestyle audit. I tracked every purchase, categorized it, and then asked a simple question: does this bring me lasting joy or value?

The results were surprising. I discovered that I spent over $120 a month on streaming platforms, but regularly used only two. I canceled the rest and saved $70 monthly. I loved dining out, but realized that expensive takeout three times a week wasn’t enhancing my life—it was just convenient. By cooking more at home and reserving restaurants for special occasions, I cut my food budget by 30% without feeling restricted. I also identified emotional spending triggers: stress led to online shopping, boredom to subscription trials, and social pressure to impulse purchases. Recognizing these patterns allowed me to create alternatives—like a walk after work or a weekly coffee with a friend—that cost less and felt better.

What I kept speaks volumes about my values. I continued to travel twice a year, prioritized fresh, high-quality food, and maintained a small budget for books and learning. These weren’t expenses—they were investments in well-being. The goal was never to live with less, but to live with more purpose. This “joy-per-dollar” lens became a guiding principle. It helped me distinguish between fleeting wants and meaningful spending. For women who often put family needs first, this kind of self-reflection is liberating. It’s not selfish to spend on what brings you joy—it’s strategic. When your spending reflects your true priorities, budgeting stops feeling like a burden and starts feeling like empowerment.

Beyond Cutting: How Smart Substitution Builds Long-Term Gains

Frugality gets a bad reputation because it’s often confused with sacrifice. But the most effective cost-saving strategies aren’t about doing without—they’re about doing better. Smart substitution means replacing expensive habits with lower-cost alternatives that deliver equal or greater value. This approach doesn’t shrink your life; it optimizes it. And because these changes are sustainable, their impact compounds over time.

Take transportation. I used to lease a luxury SUV, partly for status, partly out of habit. When it was time to replace it, I researched fuel-efficient, reliable models and chose one that cost half as much to own. The monthly payment dropped from $600 to $300, and fuel and insurance savings added another $150 a month. But here’s the twist: I didn’t feel like I’d downgraded. The new car was comfortable, safe, and perfectly suited to my needs. The money saved went straight into my retirement account—over $5,000 a year, just from one decision.

Other substitutions had similar ripple effects. I switched from a traditional cable package to a streaming bundle that cost a quarter as much. I began using cash-back credit cards for everyday purchases—but only for expenses I’d make anyway—and paid the balance in full each month. I negotiated my internet bill by calling customer retention and asking for a better rate, saving $40 a month. I started buying generic brands for household items, where quality was comparable, and saved an extra $20 weekly. None of these required willpower or discomfort. They were simple, low-effort changes that added up to over $10,000 in annual savings.

What makes substitution so powerful is that it turns passive spending into active savings. You’re not denying yourself—you’re upgrading your choices. For women balancing practicality and care, this approach feels natural. It’s not about pinching pennies; it’s about making thoughtful decisions that benefit the whole household. And because these habits are easy to maintain, they become automatic, creating a steady stream of financial momentum.

Risk Control: Protecting Your Plan from Inflation, Emergencies, and Lifestyle Creep

Saving money is only half the battle. The real challenge is keeping your plan on track despite life’s uncertainties. Inflation, medical emergencies, and lifestyle creep—the tendency for spending to rise as income increases—are silent threats that can derail even the most disciplined savers. Protecting your progress isn’t about fear; it’s about foresight.

Inflation is one of the most underestimated risks. Over time, it erodes purchasing power, meaning that $1 today won’t buy the same amount in 10 or 20 years. To counter this, I structured my investment portfolio to include assets with growth potential, such as low-cost index funds, which historically outpace inflation. I also prioritized paying off high-interest debt, knowing that interest rates above inflation create a guaranteed loss. These moves weren’t about chasing high returns—they were about preserving value.

Emergencies are inevitable. A car repair, a dental bill, or a family crisis can wipe out months of savings if you’re unprepared. That’s why I built an emergency fund equal to six months of essential expenses. It’s kept in a high-yield savings account—liquid, safe, and earning modest interest. This buffer isn’t part of my retirement savings; it’s a shield that prevents me from dipping into long-term goals when surprises arise. For women who often serve as financial anchors in their families, this kind of protection brings peace of mind.

Perhaps the most insidious threat is lifestyle creep. It’s easy to increase spending after a raise or a windfall—upgrading the home, buying a new car, or adding luxuries. But these additions become new fixed costs, resetting your baseline and extending your work timeline. To guard against this, I adopted a rule: for every 10% income increase, I’d save at least half. The rest could go toward modest improvements, but never enough to erase progress. I also scheduled quarterly budget reviews to catch creeping expenses early. These systems made discipline automatic, not exhausting.

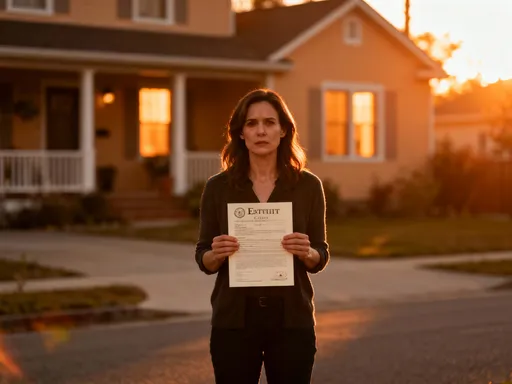

The Bigger Picture: Building a Life, Not Just a Nest Egg

Early retirement isn’t about quitting work—it’s about reclaiming time. For me, the goal was never just to stop earning, but to start living on my own terms. Financial discipline wasn’t an end in itself; it was the bridge to a more meaningful life. With reduced expenses and a clear savings strategy, I reached a point where my investments could cover my living costs. That didn’t mean I stopped working entirely. Instead, I shifted to part-time consulting, pursued long-delayed hobbies, and spent more time with family. The freedom to choose was the real reward.

What surprised me most was how financial clarity improved every area of my life. Without constant money stress, I slept better, made calmer decisions, and felt more present with my children. I traveled more, not because I had more money, but because I had more time. I took a photography course, reconnected with old friends, and even started mentoring other women on their financial journeys. Money wasn’t the destination—it was the vehicle.

For women in their 30s to 50s, this kind of transformation is deeply personal. It’s not about achieving perfection or reaching a specific net worth. It’s about building a life that reflects your values, priorities, and dreams. By mastering the real cost game—understanding what you spend, why you spend it, and how each choice shapes your future—you gain more than financial security. You gain control. And with control comes confidence, peace, and the freedom to live fully, today and tomorrow.