How I Mastered Investment Timing as a Single Parent — Real Strategy, Real Life

Balancing a tight budget and a busy schedule as a single parent made investing feel impossible — until I learned timing isn’t about predicting the market, but planning around life. I’ve been there: scared to start, overwhelmed by choices, and burned by poor decisions. This is how I turned small, smart moves into long-term growth — no jargon, just real talk and lessons that actually work. It wasn’t about finding a magic stock or waiting for a windfall. It was about redefining what investment timing really means: not trying to beat the market, but building a rhythm that fits real life. For single parents, financial stability doesn’t come from big risks — it comes from consistent, thoughtful decisions made over time.

The Single Parent’s Financial Reality: More Than Just Budgeting

For single parents, managing money is not just about tracking expenses or cutting back on coffee runs. It’s about navigating a financial landscape where one unexpected car repair or medical bill can unravel weeks of careful planning. Income is often limited to a single source, making cash flow irregular and fragile. Childcare costs, school supplies, transportation, and healthcare are constant pressures that don’t pause for market cycles or investment strategies. In this environment, traditional financial advice — like “invest 20% of your income” or “max out your retirement account” — can feel out of touch, even discouraging. The truth is, many single parents aren’t just living paycheck to paycheck; they’re making do with half the resources and double the responsibilities.

Because of this reality, investment timing cannot follow textbook models. The idea of waiting for the “perfect moment” to enter the market is a luxury most single parents can’t afford — and frankly, it’s a myth for everyone. Market timing, in the conventional sense, assumes you have flexibility, surplus cash, and emotional bandwidth to monitor fluctuations. For a single parent juggling work, parenting, and household duties, that kind of focus is unrealistic. Instead, the focus must shift from aggressive growth to financial resilience. This means prioritizing stability, creating buffers, and designing an investment approach that works within constraints, not against them. The goal isn’t to chase high returns; it’s to build a foundation that can withstand life’s inevitable disruptions.

What makes this challenge even more complex is the emotional weight that comes with financial decisions. Every dollar invested feels like a dollar not spent on the kids, on groceries, or on keeping the lights on. There’s guilt, fear, and a constant sense of trade-offs. This emotional burden can lead to avoidance — delaying investments altogether because the stakes feel too high. But the cost of inaction is real. While hesitation feels safe in the short term, it carries long-term consequences. Inflation erodes purchasing power, and time lost in the market cannot be recovered. The key is to reframe investing not as a luxury, but as a form of protection — a way to secure a more stable future for both parent and child.

What Investment Timing Really Means (It’s Not Market Guessing)

Many people believe that successful investing hinges on timing the market — buying low and selling high, predicting downturns, and capitalizing on upswings. But in practice, even professional investors struggle to do this consistently. For the average person, especially a single parent with limited time and energy, trying to guess market movements is not only ineffective — it’s counterproductive. Real investment timing has nothing to do with crystal balls or stock tips. It’s about aligning your financial actions with your personal rhythm: when money comes in, when it’s safe to invest, and how much you can afford to set aside without risking your daily stability.

This shift in perspective changes everything. Instead of waiting for the “right moment,” you create a system that works regardless of market conditions. The most powerful tool in this approach is consistency. Regular contributions, even small ones, allow you to benefit from compound growth over time. More importantly, they remove the emotional burden of trying to decide when to act. By automating investments, you eliminate hesitation and build discipline without constant effort. For example, setting up a monthly transfer from checking to a brokerage account ensures that investing becomes a habit, not a crisis decision.

Dollar-cost averaging — investing a fixed amount at regular intervals — is a perfect fit for this mindset. It means you buy more shares when prices are low and fewer when prices are high, which naturally reduces the impact of volatility. You don’t need to know where the market is headed; you just need to stay the course. This method has been shown to outperform lump-sum investing over time for most individuals, especially those who might panic and sell during downturns. For a single parent, this approach offers peace of mind: you’re not betting on a single moment, but building wealth gradually, steadily, and safely.

Another crucial element is emotional discipline. The market will fluctuate. There will be news headlines that spark fear, and periods where your portfolio dips. But reacting emotionally — pulling money out during a downturn — locks in losses and undermines long-term growth. Instead, understanding that volatility is normal, and that time in the market beats timing the market, helps maintain perspective. Investment timing, in this sense, is about managing your behavior more than managing the market. It’s about designing a plan that keeps you on track, even when life feels chaotic.

The Trap of Waiting: How Delaying Hurts More Than Risking

One of the most costly financial mistakes is not making a bad investment — it’s making no investment at all. Fear of loss, confusion about where to start, or the belief that you need a large sum to begin can lead to years of inaction. I know this firsthand. For years, I told myself I’d start investing “when I had more money” or “when things were more stable.” But that moment never came. Life kept changing — a job loss, a move, school expenses — and waiting felt like the safe choice. In reality, it was the riskiest decision I made.

Every year I delayed, I lost the benefit of compound growth. A dollar invested at age 30 has decades to grow, while the same dollar invested at 40 has significantly less time to multiply. The math is clear: time is the most powerful asset in investing. Missing even five or ten years can result in hundreds of thousands of dollars in lost growth, depending on returns and contribution levels. Inflation also works against you. Money kept in a savings account may feel safe, but its purchasing power declines over time. What seems like a conservative choice today can lead to financial strain tomorrow.

The truth is, there is no “perfect” time to start. The market is always uncertain. There will always be reasons to wait — a looming recession, political tension, job insecurity. But history shows that staying invested through downturns leads to better outcomes than trying to time entries and exits. Those who stayed in the market through the 2008 crisis, for example, recovered their losses and went on to see significant gains in the following decade. Those who pulled out missed the rebound. For single parents, the cost of waiting is not just financial — it’s the loss of confidence, the feeling of being stuck, and the delayed dream of security.

Overcoming this trap starts with reframing risk. The common perception is that investing is risky and saving is safe. But the reverse is often true over the long term. Not investing carries the guaranteed risk of falling behind. Investing, even in low-cost index funds, spreads risk across many companies and sectors, reducing the impact of any single failure. The real danger isn’t market volatility — it’s the illusion that waiting is a neutral choice. It’s not. Every month without investing is a missed opportunity to build wealth, no matter how small the amount.

Building a Timing Strategy That Fits Your Life, Not the Market

The most effective investment strategy for a single parent isn’t the most complex — it’s the most sustainable. It’s not about chasing hot stocks or reacting to economic news. It’s about creating a rhythm that matches your income flow and life demands. The first step is identifying what I call “safe surplus” — the amount of money you can consistently set aside without jeopardizing your monthly obligations. This isn’t about cutting essentials; it’s about finding small, reliable margins in your budget. Maybe it’s $25 from a side gig, a tax refund, or a birthday gift. The amount doesn’t have to be large — what matters is consistency.

Once you know your safe surplus, the next step is to align contributions with your pay cycle. If you get paid biweekly, set up an automatic transfer right after payday, before other expenses take priority. This “pay yourself first” approach ensures that investing isn’t an afterthought — it’s a priority. Even $50 every two weeks adds up to over $1,300 a year, plus compound growth. Over time, this builds real wealth without requiring drastic lifestyle changes. The key is automation: when investing happens automatically, it removes the need for willpower or perfect timing.

Windfalls — like bonuses, tax refunds, or gifts — are another powerful tool. Instead of spending them all at once, commit a portion to investing. Even putting aside 20% of a tax refund can significantly boost your portfolio over time. These irregular contributions complement your regular savings and help accelerate growth. The goal is to treat windfalls not as “fun money,” but as opportunities to strengthen your financial foundation.

This personalized timing strategy is flexible by design. If money is tight one month, you can pause contributions without guilt. The system isn’t rigid — it’s built to adapt. The focus is on progress, not perfection. By aligning investing with your real life, you create a habit that lasts. And over time, those small, well-timed actions compound into something much larger: financial confidence and long-term security.

Risk Control: Protecting Your Portfolio Without Overthinking

For single parents, protecting what you’ve saved is just as important as growing it. The fear of losing money is real, especially when every dollar supports a family. That’s why risk control isn’t about avoiding all risk — it’s about managing it wisely. The first line of defense is a fully funded emergency fund, ideally covering three to six months of essential expenses. This buffer allows you to handle unexpected costs without dipping into investments. Knowing you have this safety net reduces the temptation to sell during market downturns, which is when many investors make costly mistakes.

Next is asset allocation — how your money is divided among different types of investments. For most single parents, a balanced mix of stocks and bonds is appropriate. Stocks offer growth over time, while bonds provide stability. The exact ratio depends on your age, goals, and comfort level, but a common rule of thumb is to subtract your age from 110 to determine the percentage to allocate to stocks. For example, at age 40, around 70% in stocks and 30% in bonds may be suitable. This mix balances growth potential with protection against volatility.

Diversification is another critical tool. Instead of picking individual stocks, most investors benefit from low-cost index funds or exchange-traded funds (ETFs) that track broad market indexes like the S&P 500. These funds spread your money across hundreds or thousands of companies, reducing the risk that any single failure will hurt your portfolio. They also have lower fees than actively managed funds, which means more of your money stays invested.

Time horizon also plays a key role in risk management. The longer you can stay invested, the more risk you can afford to take, because downturns tend to recover over time. For long-term goals like retirement or college savings, staying invested through market cycles is essential. Short-term goals, on the other hand, should be kept in safer accounts like high-yield savings or CDs. By matching your investments to your timeline, you avoid the stress of needing money during a downturn. Risk control, in this sense, is not about complexity — it’s about structure, patience, and planning.

Practical Tools and Habits That Keep You on Track

Staying consistent with investing doesn’t require hours of research or expensive advisors. Today, there are simple, accessible tools that make it easier than ever to build wealth, even with a busy schedule. Robo-advisors like Betterment or Wealthfront offer automated portfolio management with low fees and minimal effort. You answer a few questions about your goals and risk tolerance, and the platform builds and manages a diversified portfolio for you. It handles rebalancing, tax optimization, and even automatic contributions — all on autopilot.

Mobile investing apps like Acorns or Stash allow you to start small, even with just a few dollars. They round up everyday purchases and invest the spare change, making saving almost invisible. While these platforms aren’t meant for large-scale wealth building, they’re excellent for developing the habit of investing. For more control, low-cost brokerage accounts from Fidelity, Vanguard, or Charles Schwab let you invest directly in index funds and ETFs with no or low fees. These platforms also offer retirement accounts like IRAs, which provide tax advantages for long-term savings.

But tools alone aren’t enough. The real key to success is building supportive habits. One of the most effective is the quarterly check-in — a short review of your portfolio, contributions, and goals every three months. This isn’t about micromanaging performance; it’s about staying connected to your progress and making small adjustments if needed. It also helps you avoid emotional reactions to short-term market swings.

Another powerful habit is setting “no-touch” rules. Decide in advance that you won’t withdraw from your investments except for true emergencies. Write this rule down, or even tell a trusted friend. This mental commitment strengthens discipline and reduces the urge to react to fear or excitement. Over time, these habits become second nature, and investing shifts from a source of stress to a source of confidence.

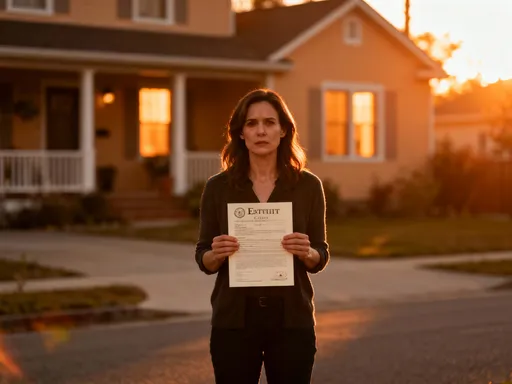

From Survival to Stability: How Smart Timing Changed My Future

Looking back, the turning point wasn’t a single investment or a sudden windfall. It was the decision to start — imperfectly, consistently, and with patience. I didn’t need to become a market expert or take big risks. I just needed to create a system that worked for my life. Over time, those small, well-timed contributions added up. The portfolio grew, but more importantly, so did my confidence. I stopped feeling like I was just surviving and began to believe in a more secure future.

For single parents, financial success isn’t measured by flashy returns or overnight gains. It’s measured by peace of mind, by knowing there’s a plan, by seeing progress even when life is busy. It’s about teaching your children, through example, that stability is possible — not through luck, but through discipline and smart choices. The journey isn’t about perfection. It’s about showing up, making steady moves, and trusting the process.

Investing as a single parent isn’t easy, but it’s far from impossible. The real strategy isn’t hidden in complex formulas or insider knowledge. It’s in the daily decision to prioritize your future, to align your money with your life, and to keep going — even when progress feels slow. You don’t need to time the market. You just need to start, stay consistent, and let time do the rest. Because for families built on resilience, the most powerful investment is persistence.