How I Tamed My Property Tax Bill Without Breaking a Sweat

Remember that sinking feeling when your property tax bill arrives and it’s way higher than last year? Yeah, I’ve been there. It felt like getting punched in the gut—again. But after overpaying for years, I finally rolled up my sleeves and figured out how to fight back. This isn’t about loopholes or shady moves—it’s real, legal, and totally doable. Let me walk you through the smart, practical moves that cut my tax burden and kept more cash in my pocket. What started as frustration turned into empowerment, and now I manage my property tax like a seasoned homeowner who knows the system works best when you pay attention. You don’t need a finance degree or a lawyer—just a bit of time, some basic research, and the confidence to speak up.

The Wake-Up Call: When My Property Tax Skyrocketed

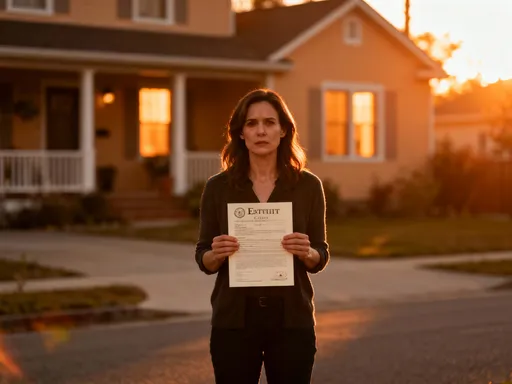

For years, I treated my property tax bill like a fixed expense—something I had to accept no matter what. Every fall, the envelope arrived, I sighed, wrote the check, and filed it away. I never questioned it. After all, it was a government charge, and who was I to argue? That mindset lasted until the year my bill jumped by 25% compared to the previous one. That wasn’t just a bump—it was a jolt. I remember standing in my kitchen, staring at the number, trying to calculate how much extra I’d need to pull from savings. I felt helpless, angry, and foolish for not paying closer attention sooner.

That moment forced me to confront a hard truth: ignoring your property tax is a financial risk. Unlike sales tax or income tax, property tax is based on the assessed value of your home—a number that’s not always accurate. I started asking questions. Was my home really worth that much more in just one year? Were my neighbors seeing the same spike? What was driving this increase? I discovered that reassessments had recently taken place in my county, and while some adjustments made sense, mine seemed out of line with what similar homes in my neighborhood were selling for. That realization was my wake-up call. I wasn’t just a passive taxpayer; I was a homeowner with rights and tools to challenge unfair assessments.

More importantly, I learned that property tax isn’t a one-size-fits-all charge. It’s a local levy calculated by multiplying your home’s assessed value by the tax rate in your jurisdiction. If the assessed value is too high, your tax bill will be too, even if the rate stays the same. That means the key to lowering your bill often lies not in fighting the rate—which is set by local governments—but in ensuring your assessment reflects reality. This shift in thinking changed everything. Instead of dreading the bill, I began to see it as a document to be reviewed, questioned, and, if necessary, contested.

Understanding the Basics: What Property Tax Really Is (And Why It Matters)

Before diving into strategies, it’s essential to understand what property tax actually is and why it matters to your household budget. At its core, property tax is a levy imposed by local governments—cities, counties, or school districts—on real estate owners. The revenue funds essential public services such as public education, road maintenance, emergency response, libraries, and parks. In many communities, it’s the primary source of funding for schools, which makes it both a civic responsibility and a significant personal expense.

But here’s what most homeowners don’t realize: while property tax supports vital services, the amount you pay is not carved in stone. It’s calculated using two main components: the **assessed value** of your property and the **local tax rate**. The assessed value is an estimate of your home’s market worth, typically determined by a county or municipal assessor. The tax rate, often expressed as a percentage or in mills (where one mill equals one-tenth of a percent), is applied to that assessed value to generate your annual bill.

For example, if your home is assessed at $300,000 and your local tax rate is 1.2%, your annual property tax would be $3,600. Now, while you can’t change the tax rate—that’s set by local authorities—you *can* influence the assessed value. And that’s where your power lies. Most people assume assessments are accurate and final, but studies show that up to 60% of homes may be over-assessed in any given year, meaning millions of homeowners are overpaying simply because they haven’t challenged the number.

Understanding this distinction is critical. Property tax isn’t just another utility bill. It’s a financial obligation tied directly to the perceived value of your largest asset. That means over-assessment doesn’t just cost you money this year—it compounds over time, especially if future assessments build on inflated past values. By learning how the system works, you shift from being a passive payer to an informed participant. Knowledge isn’t just power; in this case, it’s savings. And those savings can amount to hundreds or even thousands of dollars over the years.

The Power of Assessment Appeals: How to Challenge Your Tax Bill Like a Pro

One of the most effective tools available to homeowners is the property tax appeal. Every jurisdiction in the United States allows property owners to appeal their assessment if they believe it’s inaccurate. Yet, surprisingly few people take advantage of this right. I was one of them—until I realized how straightforward the process could be. An appeal isn’t a legal battle or a confrontation; it’s a formal request to review your home’s assessed value based on evidence.

The foundation of a successful appeal is **comparable sales data**, often referred to as “comps.” These are recent sale prices of homes similar to yours in size, age, condition, and location. If homes like yours in your neighborhood sold for less than your assessed value, you have a strong case. I started by visiting my county assessor’s website, where I accessed public records of recent sales. I printed out three solid comps—all within a half-mile radius, all with similar square footage and number of bedrooms—and highlighted how each sold for 10% to 15% less than my assessed value.

I also included photos of my home’s exterior, noting visible issues like a cracked driveway and aging roof—factors that could justify a lower valuation. When I submitted my appeal, I didn’t argue emotionally. I presented a clean, factual packet that made it easy for the review board to see the discrepancy. Within three months, I received a letter confirming a 12% reduction in my assessed value. That single action lowered my annual tax bill by $420. No magic, no loopholes—just documentation and persistence.

It’s important to note that appeal processes vary by location. Some areas require an informal review first, while others move straight to a hearing. Deadlines are strict, and missing them means waiting another year. But the effort is worth it. According to the National Taxpayers Union, successful appeals reduce assessments by an average of 10% to 20%. That kind of return on a few hours of work is hard to beat. And once you’ve done it once, the process becomes familiar, making it easier to act again in the future.

Timing Is Everything: When to Act (and When to Wait)

Even with solid evidence, timing can make or break your appeal. Filing too early or too late can result in automatic rejection. Most jurisdictions have a narrow window—typically 30 to 60 days—after assessment notices are mailed when appeals can be submitted. I learned this the hard way when I tried to appeal months after the deadline had passed. The assessor’s office was polite but firm: no exceptions.

Now, I mark the appeal period on my calendar as soon as I receive my notice. In many areas, reassessments happen on a rotating cycle—every three to five years—so not every homeowner gets a new assessment annually. But when your area is up for reassessment, that’s your prime opportunity. It’s when the system is already reviewing values, making it more receptive to corrections. Waiting until the next cycle could mean years of overpaying.

Another strategic timing factor is the real estate market. If home prices in your area have recently dipped, that’s a strong reason to appeal. Conversely, if the market is hot and values are rising, it may be harder to argue for a reduction—unless your home has unique drawbacks, such as structural issues, poor layout, or location near undesirable features like busy roads or industrial zones. In those cases, you can still make a compelling case, but the burden of proof is higher.

Patience is also key. The appeal process isn’t instant. It can take several months from submission to decision. Some cases even go to a formal hearing, where you may need to present your evidence in person. But staying organized and responsive to requests increases your chances of success. And if your first appeal is denied? Don’t give up. Many homeowners succeed on the second try, especially when they strengthen their documentation. The system rewards preparation, not perfection.

Hidden Deductions and Exemptions You Might Qualify For

Beyond appealing your assessment, another powerful way to reduce your property tax bill is through **deductions and exemptions**. These are often overlooked because they’re not widely advertised, but they can deliver significant savings with minimal effort. The most common is the **homestead exemption**, which reduces the taxable value of your primary residence. In many states, this exemption is automatic, but in others, you must apply. I assumed I was covered—until I called my assessor’s office and learned I hadn’t filed the necessary form. A quick 15-minute application later, I was approved, saving $280 a year.

Other exemptions may be available depending on your circumstances. **Senior citizens** often qualify for age-based reductions, especially if they meet income thresholds. **Veterans**, particularly those with service-related disabilities, may be eligible for full or partial exemptions. **Disabled homeowners** can also apply for relief in most states. There are even exemptions for properties with renewable energy installations like solar panels, as some localities encourage green upgrades.

The key is to ask. These programs aren’t secret, but they’re not always easy to find online. Your local assessor’s office is the best place to start. A simple phone call or visit can uncover benefits you didn’t know existed. And unlike tax credits or deductions on your federal return, these savings apply directly to your property tax—meaning lower bills year after year. Best of all, most of these exemptions are renewable automatically once approved, so the initial effort pays off long-term.

It’s also worth checking whether your area offers a “circuit breaker” program, which caps property tax as a percentage of your income for low- to moderate-income homeowners. These programs are designed to prevent seniors or fixed-income families from being forced out of their homes due to rising taxes. While eligibility varies, they’re a lifeline for many and well worth exploring if your budget is tight.

Working with the System, Not Against It: Building a Paper Trail

One of the biggest mistakes homeowners make when challenging their tax bill is approaching it emotionally. They say things like, “I can’t afford this!” or “It’s not fair!” While those feelings are valid, they don’t carry weight in an appeal. What does matter is evidence. The review board isn’t there to sympathize—they’re there to evaluate facts. That’s why building a strong, organized paper trail is essential.

I started keeping a dedicated file for all property tax-related documents: copies of past bills, assessment notices, photos of my home’s condition, repair estimates, and neighborhood sale data. When I appealed, I presented everything in a clear binder with labeled sections. I didn’t just say my roof was old—I included photos and a quote from a contractor estimating $8,000 for replacement. I didn’t just claim my home was overvalued—I showed three comparable sales with lower prices and similar or better features.

This approach turned my appeal from a complaint into a professional review. The board members responded to the clarity and credibility of my submission. They didn’t have to guess or assume—they could see the data. That’s the difference between being dismissed and being taken seriously. Think of it like preparing for an audit: the more thorough and accurate your records, the smoother the process.

Additionally, keeping a paper trail helps you track trends over time. If your assessment jumps again next year, you’ll have a baseline to compare it against. You’ll be able to spot inconsistencies quickly and act before the bill becomes unmanageable. This kind of documentation doesn’t just support appeals—it builds confidence. You’ll walk into any meeting with the assessor’s office knowing you’re prepared, informed, and in control.

Long-Term Strategy: Making Property Tax Management a Habit

Winning one appeal or securing an exemption is a great start, but true financial control comes from consistency. I’ve made property tax management a regular part of my household routine—just like reviewing my insurance or planning my budget. Every year, I do three things: I review my assessment notice as soon as it arrives, I check for new exemptions or changes in local policy, and I mark the appeal window on my calendar.

I also stay informed about my neighborhood. When homes near me sell, I look up the prices. I follow local news about reassessment cycles. I’ve even joined a community group where homeowners share tips and resources. This ongoing awareness keeps me proactive instead of reactive. Over the past three years, I’ve avoided overpaying by staying vigilant. I’ve saved over $1,500 in taxes—money that’s gone toward home improvements, retirement savings, and family needs.

What I’ve learned is that property tax isn’t just a bill—it’s a component of financial health. Like maintaining your home’s roof or servicing your car, it requires regular attention. Ignoring it leads to costly surprises. Managing it wisely leads to stability and savings. You don’t have to be an expert to get it right. You just need to care enough to look, question, and act when necessary.

Managing your property tax isn’t about getting something for nothing. It’s about fairness, accuracy, and taking responsibility for your financial well-being. The system is designed to work for everyone, but it only works well when people participate. By understanding how assessments work, appealing when needed, claiming available exemptions, and staying organized, you protect your home equity and keep more of your hard-earned money. That’s not just smart homeownership—it’s smart living. And the peace of mind that comes with knowing you’re not overpaying? That’s priceless.